Key Benefits:

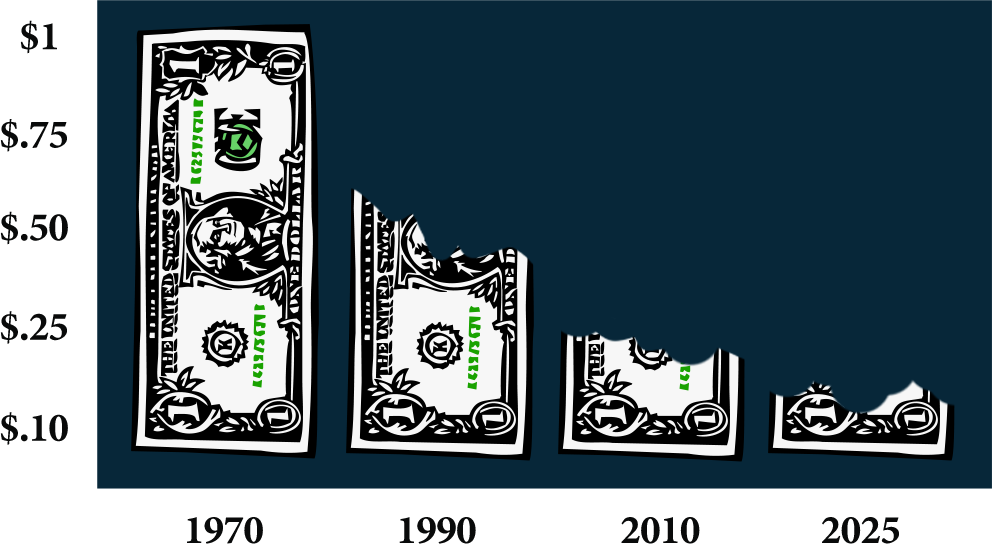

✅ Inflation Protection:

Over time, the purchasing power of paper currency declines due to inflation. Gold and silver, however, have historically retained their value, acting as a hedge against rising costs and a weakening dollar.

✅ Crisis Hedge:

During times of economic instability, markets fluctuate, and traditional assets can lose value quickly. Precious metals often move in the opposite direction, providing stability and security when other investments falter.

✅ Portfolio Diversification:

Relying solely on stocks and bonds leaves your retirement savings vulnerable to market downturns. A precious metals IRA adds balance to your portfolio, reducing overall risk and enhancing long-term financial security.

✅ Full Ownership:

Relying solely on stocks and bonds leaves your retirement savings vulnerable to market downturns. A precious metals IRA adds balance to your portfolio, reducing overall risk and enhancing long-term financial security.

![]() $

0.00

$

0.00

![]() $

0.00

$

0.00

![]() $

0.00

$

0.00

![]() $

0.00

$

0.00